Making A School Budget – Planning, Importance, & Budgeting Process

Many of us have stared at a pile of receipts and costs, wondering how to balance our school’s budget. Keeping the educational ship afloat while juggling costs can be a real headache. But you don’t have to worry!

Read on as we guide you into the art of crafting a school budget that not only keeps the numbers in check but also leaves room for creativity and improvement. Get ready to become a budget ninja, slashing unnecessary costs and channeling funds where they matter most – into creating an exceptional learning experience for your students. Let’s get started!

Importance Of School Budget Planning

Effective school budget planning is crucial for success as it guides financial choices and ensures resources are utilized effectively to fulfill the school’s purpose and objectives. Budget planning for schools is essential as it lays the groundwork for several benefits:

- Better financial control and accountability

- Effective resource use

- Alignment with educational aims

- Adaptability to changing situations

- Fiscal sustainability and stability

School Budgeting Process

The school budgeting process involves the systematic allocation of resources and financial planning within academic establishments. This undertaking is a dynamic and cyclical process that requires meticulous evaluation of multiple factors to ensure the efficient allocation of resources, good curriculum design, and alignment with educational goals. The following fundamental stages typically constitute the budget-setting process:

1. Assessing Current Financial Situation And Needs

Assess the institution’s finances and address short- and long-term demands before budgeting. Check previous income and expenditure and current debts. Understand stakeholders’ needs by talking to administrators, educators, and parents. Consider integrating learning management systems into the long-term needs assessment since this might affect resource allocation and budgetary demands.

2. Setting Budgetary Goals And Priorities

Based on the evaluation, the school should establish fiscal goals and priorities that align with its purpose, vision, and strategic plans. These goals should be in harmony with the school’s instructional objectives, whether they involve enhancing facilities, providing personnel training, elevating academic standards, or investing in learning management solutions.

3. Forecasting Revenue And Expenses

Future forecasting is necessary for budgeting. School income from donations, government funding, tuition, and grants must be estimated. Furthermore, they need to create a budget that encompasses personnel expenses, instructional resources, building maintenance, and operating costs. A strong fee system may help estimate tuition and fee income, allowing more precise budgeting and resource allocation.

4. Allocating Resources Based On Priorities

Through a thorough understanding of available funds and expenditures, the educational institution can allocate resources in alignment with its goals. Allocating resources to the most important sectors while eliminating waste may require trade-offs. Prioritizing learning management systems, curriculum development, and facility renovations may mean cutting expenditures on less important areas.

5. Monitoring And Adjusting The Budget As Needed

The budgetary procedure does not conclude with the initial distribution of funds. Educational institutions must evaluate financial performance by comparing actual spending to predicted amounts and making necessary adjustments. Using a tailored fee management system that involves reallocating financial resources, reducing spending, or identifying new income streams to address unexpected occurrences or changing needs.

Academic institutions can support their educational goals, ensure accountability, and efficiently manage financial resources by adhering to the budget-setting process and implementing effective school budgeting procedures.

Best Practices In School Budgeting

Making a good school budget needs more than math. It requires a well-planned strategy that connects financial resources with educational ambitions. By adopting best practices in school budgeting, academic institutions may guarantee that every dollar spent helps students and the institution. Here are the best practices:

1. Stakeholder Involvement

Successful school budget planning necessitates collaboration among all stakeholders. Administrators, teachers, parents, and students should all actively participate in the budget-setting process. Involving these groups allows schools to gain insights into diverse needs and objectives.

Administrators can provide strategic advice, instructors can communicate classroom needs, and parents can contribute ideas for enhancing education. This inclusive approach fosters ownership and buy-in, thereby improving the implementation of the budget.

2. Strategic Alignment

A well-designed school budget planner should reflect the institution’s purpose, vision, and strategic objectives. It should actively support the school’s educational goals and long-term ambitions. Through aligning resources, schools can prioritize efforts that directly contribute to their intended goals, whether it be enhancing academic achievement, supporting extracurricular programming, or investing in staff professional development.

3. Essential Expenditures

A school budget planner must prioritize essential expenses that impact the quality of education. Prioritizing teacher and staff compensation is vital for student success. Textbooks, computers, and classroom equipment must provide an interesting and helpful learning environment. Facility maintenance and changes are also needed to keep students and staff safe and comfortable.

4. Cost-Saving Measures

Cost-cutting and resource efficiency are key to school budget planning. Schools can leverage bulk buying power, negotiate improved vendor contracts, establish energy-efficient practices, and explore resource-sharing with other institutions to enhance financial efficiency.

The integration of technology and digital solutions not only increases efficiency but also helps save on administrative expenses, ultimately improving overall resource management. Schools may use resources more efficiently to improve the quality of education.

Paving The Way For Educational Excellence

Ensuring efficient budgeting is a critical component of successful educational institutions. By following the best practices mentioned above, schools may master financial management. These strategies include stakeholder engagement, strategy alignment, prioritizing key expenditures, cost-cutting, transparency, and continual reviews.

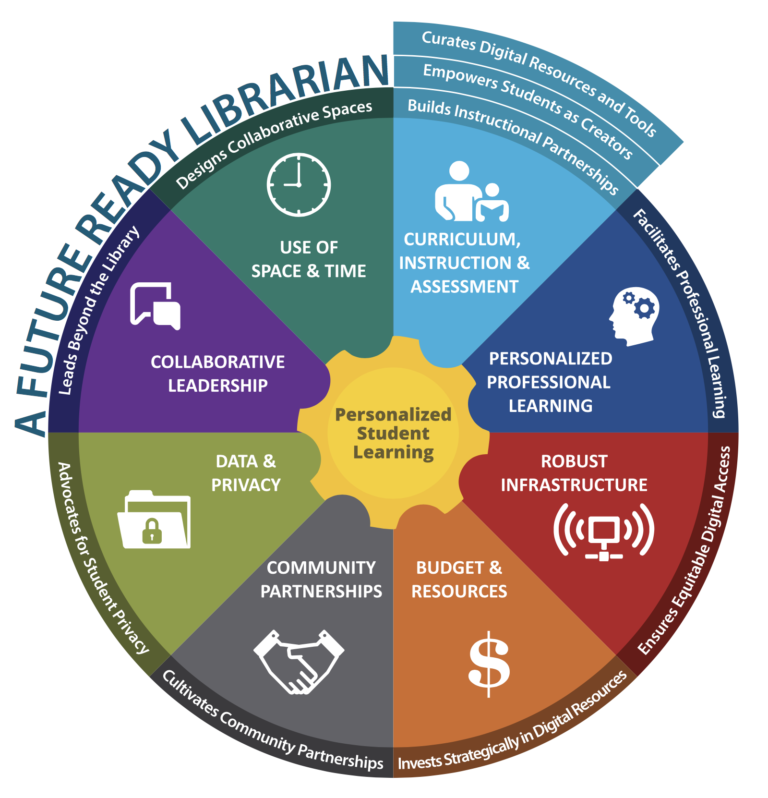

Academic institutions can maximize resource allocation, achieve educational goals, and maintain financial viability. By following these principles and using Quick Campus’s comprehensive school management software, you can easily manage the financial aspects of your school.

How Often Should A School Budget Be Reviewed And Updated?

Annually evaluate and revise school budgets, although more regular monitoring and revisions are encouraged.

What Are Good Budgeting Stakeholder Engagement Strategies?

Forming a budget committee, conducting surveys/focus groups, organizing open forums, and communicating clearly are effective techniques.

How Can Schools Balance Competing Priorities When Allocating Limited Resources?

Prioritize essential expenditures impacting peer learning, align with strategic goals, and explore cost-saving measures like bulk purchasing or resource sharing.